Airlines 001 : EI Weekend 3485

A look at pioneers of commercial air flight.

Exchange Invest is a unique information resource combining the day’s stories in a newsletter for investors in exchanges/financial markets infrastructure.

Exchange Invest was founded by former exchange CEO and author of the first bestselling book of fintech (“Capital Market Revolution!” FT 1999), Patrick Young. Monday through Friday, our daily paid subscriber email discusses the business of bourses of all kinds across the world.

On this day in 2002, NYSE OpenBook launched a new market information product that provides off-floor market participants a view of the buy and sell interest in all NYSE-listed securities beyond the best bid and offer.

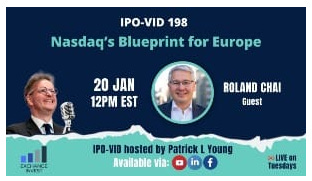

NASDAQ SPONSORED SEGMENT

SPONSORED BY:

MACRO THOUGHTS

So if we go back to the origins of flight itself, there’s a lot of debate (a bit like the first automobile, albeit those are both very different tales with a similar thread of thinking).

Anyway, who had the first commercial flight? Well the Europeans and the Americans seek to differ.

In the European camp, a forerunner of Air France Compagnie Générale Transaérienne (CGT founded in 1909 — one of the airlines which merged to become Air Francein 1933 — created the world’s first scheduled passenger flights in 1913. The service connected Puteaux and Issy-les-Moulineaux, two Paris suburbs near the Seine River, using a Farman biplane to carry passengers short distances for fares like 3 francs. CGT,

However, there is an argument that truly organised commercial flight first took place in the USA a few months later: The First Commercial Flight (Poente Technical).

I have no ability to adjudicate these claims. However, I would suggest that a modern flyer habituated in the art of seatbelts and safety drills with life jackets et al when offered the chance to avail of a commercial flight in either of these pioneering ‘airliners’ would probably have two immediate thoughts, namely:

-This thing is really going to fly;

And

-Please may I get out?

IPO-VID LIVESTREAM: NEXT TUESDAY

“Making Markets InPlay”

Guest: Troy Kane

January 27th, 2026

1200 EST, 1700 UK, 1800 CET

The former President of MIAX Futures, Troy Kane is now the President & COO of InPlay Global, Inc., an innovative financial platform turning team performance into an investable asset class on the world’s first regulated marketplace for trading equity securities based on sports performance.

IN BIGWORLD

So the thesis is the Maduro extradition has made the world a safer place for now, as challenging the USA is a death wish wrapped in a suicide note without the tortured ‘elegance’ of seppuku ritual.

However if Cuba is liberated that remakes the entire Caribbean region and that puts big pressure on existing mega tourism nations.

Arguably the most exotic mainstream Caribbean brand, Cuba is going to be the first choice for visitors for several years. While I believe a free Cuba will eventually raise the whole regional economy, short-term there is likely to be a major substitution effect where tourists will head for the more exotic Havana and the rest of the remarkably large Cuban landmass. That could leave a lot of smaller islands losing cream off the top of what has generally been hugely profitable tourist returns since COVID ended.

BITCARNAGE

NYSE Tokenizes

Welcome to the stock market parallel universe. With the US maxing out on regulatory confusion masquerading as clear support of crypto et al (albeit incoherently beyond the ability of certain folks, often with names ending in ‘-rump’ making a profit, The New York Stock Exchange Develops Tokenized Securities Platform (ICE). The big thing here is truly that in an effort to secure their futures, the prevailing pre-eminent exchanges now sense they may have to kill their own business model to thrive in the future AND that also comes with a side order of, it could kill the DTCC monopoly too. There are SO many ramifications here it’s fascinating but at the same time, a sensible move by NYSE to preserve its brand and world leader position.

If you enjoyed this excerpt you may be interested to know that you can read Bitcarnage every day in Exchange Invest.

Alternatively, if you want to follow Bitcarnage — the daily update on happenings in the world of crypto and digital assets, then you can find Bitcarnage as a standalone on Substack.

PLY: Market Movers On Fintech TV

Catch me on Market Movers On Fintech TV every Monday at 0920 AM for the latest insights in finance, technology, impact investing, and market trends. Fintech TV is on the web (Fintech.TV), in a multitude of airports across the USA and other channels.

IPO-VID LIVESTREAM: NOW ONLINE!

“Nasdaq’s Blueprint for Europe”

Guest: Roland Chai

January 20th, 2026

1200 EST, 1700 UK, 1800 CET

Roland Chai is President of European Market Services for Nasdaq having previously run Nasdaq’s Marketplace Technology business and before that was Nasdaq’s first Global Chief Risk Officer.

At Hong Kong Exchanges, Roland served as Head of Post-Trade amongst a myriad of high level positions across HKEX, Head of Equities at LCH.Clearnet Ltd and as Product Development Manager at Australian Securities Exchange.

EXCHANGE INVEST WEEKLY PODCAST

In a big week for digital settlement Taurus’ Ghost rapidly gave way to NYSE’s Tokenization,

Although in DC there’s a form of legislative,

Crypto Stasis

Great Change Afoot in Egypt

OF INTEREST

As always, a review of interesting reading to provoke thoughts and consideration… Not sure we agree with much of it….but it’s thought-provoking!

B.O.A.C. Route Map And Flight Information 1971 — Capt.Charles ‘Chic’ Eather (Ret.)

Chic’s Website

The Pioneering Spirit Of The Kangaroo Route

Captain’s Choice

71 Hours In Economy! Flying On The World’s Longest Flights Back To Back!

Noel Philips Youtube

What It Costs To Fly Business Class On The World’s 7 Longest Nonstop Airbus A380 Routes

Simple Flying

PLY: A taster for next week where we will look at the world’s longest non stop flights…

FINANCE BOOK OF THE WEEK

Missing out on finance for a week… “Beyond The Blue Horizon” by Alexander Frater reveals and relives the romance and breathtaking excitement of the legendary Imperial Airways Eastbound Empire service — the world’s longest and most adventurous scheduled air route as he revisits the route in the jet age.

Get the book here.

*Paid link, as an Amazon Associate, Exchange Invest earns from qualifying purchases.

Suggestions welcome if you would like to nominate a book for us to cover!

Our next Book of the week will be unveiled Saturday in the EI Weekend Edition.

& don’t forget if you want all the news on the bourse business sent daily to your Inbox subscribe to Exchange Invest — via Exchange Invest.com — it’s only $499 per annum to join “The Exchange of Information.

IPO-VID LIVESTREAM PODCAST

The latest IPO-VID podcast episode is out today, January 22, 2026 — “The Human Factor: A Trading Journey.” First aired as a video livestream on December 2, 2025, this episode explores the often-overlooked human side of markets, decision-making, and technology.

Catch up now and stay ahead in the world of markets!

LAST WORD

The future continues in the water cooler of the bourse business.

…If you want to stay abreast of the world of exchanges then please Subscribe to our Daily Newsletter — free 7-day trial.

Or Subscribe to our Weekend Edition — it’s free.

You can also check out the “Reflections From Young’s Pyramid”, it illustrates the relative value of exchanges around the world.

Or the “ICE Cost of Borrowing 2020–2022” An Interest Rate Comparison, which illustrates the end of the funny money era of QE and how interest rates have already had a major lurch up from their previous region of zero to, even negative, levels.

At the least can you like this article, or leave us a comment, we welcome your feedback.

If you enjoy our multimedia, then please Like / Subscribe to our video channel: IPO-VID In Patrick’s Opinion.

Your historical perspective on commercial flight is captivating! The comparison between the 1909 CGT flights and the modern passenger experience really highlights how far aviation has progressed. I've always been fascenated by these early pioneering efforts and the sheer courage it took to launch commercial operations with such primitive equipment. The parallel you draw to today's tokenization moves by NYSE is equally thought-provking.